Problem Overspending? Your Real Hourly Wage is the Clear Solution!

Knowing your real hourly wage is the shockingly simple way to slash your spending!

Author: Kari Lorz – Certified Financial Education Instructor

In TV & movies, you see people scoff at spending $300 on dinner. “Oh, that ain’t nothing! I make $300 an hour consulting!” Goodie for them.

However, you know they’re not keeping $300. You wonder, how much do they actually take home? How much do they actually save? What’s their real hourly wage even? Real hourly wage? That sounds fake; it’s their salary, right?

Wrong! If you don’t know your true hourly wage, then I suggest you pay attention. This is super simple math, it’s going to sting, but you’ll be so glad you figured it out!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

What is a Real Hourly Wage and Why You Should Care.

In a nutshell, your real hourly wage is how much money you make per hour (aka what your paycheck stub says) minus all of the costs associated with your job.

You should definitely care because it’s probably nowhere as high as you think your wage is. This exercise might be a bit depressing, but it’s an eye-opener, which hopefully will get you looking at things in a new light.

Figuring out your real hourly wage is part of the process in the book Your Money or Your Life by Vicki Robin. Many consider it one of the most influential personal finance books ever written! It was originally released in 1992 with co-author Joe Dominguez, and just revised in late 2018 due to popular demand.

For example, you have a part-time job which brings in some extra money. It is an okay job; some days you like it, and some days you don’t want to deal with your coworker’s drama. If you figure out your real hourly wage, you may find that you are only netting $6.34 an hour.

And, your tasks at home kind of pile up because you’re not at home doing them. Causing you to stress out and lose sleep because you’re staying up later than usual to finish the laundry. All this for a lousy $6.34!

Or you may find that your real hourly wage is excellent, say netting $42 an hour. Yet you feel kinda bad that you’re not at home taking care of “all the things.” But, since you net such a high amount, it is totally worth your time (in a financial way) to hire a house cleaner to come in at $22 an hour and take care of all those things. Win!

Let’s take a step back and look at a closer point in the scenario above. I mentioned that something was worth it, in a financial way. There can be many ways something can be worthwhile, not just monetarily, and for each person, those things can and will be different.

For example, a job may be worthwhile because of the social interaction you get (Moms NEED to talk to other adults), or it may be worthwhile for the skills and knowledge you learn, the networking, or the perks. Or hiring a cleaner may be valuable because you HATE cleaning soap scum; you actually dread it.

Be thinking about these nuances when considering your real hourly wage because it’s all a piece of the puzzle.

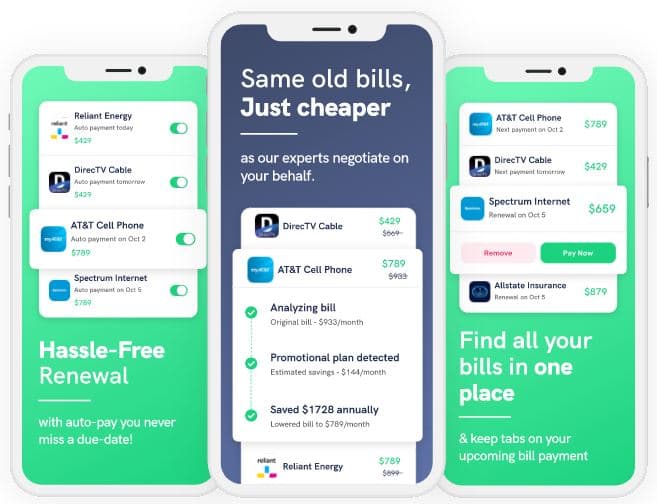

Save with Rocket Money

Rocket Money helps you lower your monthly bills as they instantly find, track, and negotiate down your subscriptions.

Your concierge is there when you need them to cancel services, so you don’t have to. They also track your spending and notify you of where you can cut down to save even more.

How much do I make?

Before we get into your real take-home pay, let’s dig into your gross and net pay.

Net Pay is the amount you take home after payroll tax & deductions are withheld. These deductions are…

- State tax withholdings – Income tax (SIT)

- Federal tax withholdings – Social Security, Medicare tax – (aka FICA taxes), Income tax (FIT)

- Workplace retirement contributions (optional)

- Short/long-term disability benefit (optional)

- Healthcare benefit (optional)

- Additional workplace-specific deductions (if applicable)

If you love to run numbers, here’s a good paycheck calculator that will take in your salary/pay and your withholdings & deductions and give you your net pay.

What is net pay?

When people think of the money they bring home, or their “take-home pay,” this is the real wage. People assume that since their take-home is $4,000 a month, that’s how much they make.

This is partly true, actually, it’s only half true. Because in order to do your job, you have expenses related to that, WHICH brings down your true take-home pay to your true hourly wage.

How Do I Calculate My Real Hourly Wage?

Start thinking about all the things you buy to go and do your job…

- gas for your car

- parking fee

- wear & tear on your vehicle

- clothes to wear

- lunch

- afternoon coffee

- dry cleaning

- daycare expenses

- professional fees

If you get paid a salary, you can divide your monthly income by the number of weeks and then divide by 40-hour traditional work week. Or if you work 50 or even 60 hours, then use that number.

I am going to be pretty real (kinda scary) and use my own real-life figures. My numbers aren’t impressive, I only work three days a week at my regular job, but it will be eye-opening to be sure!

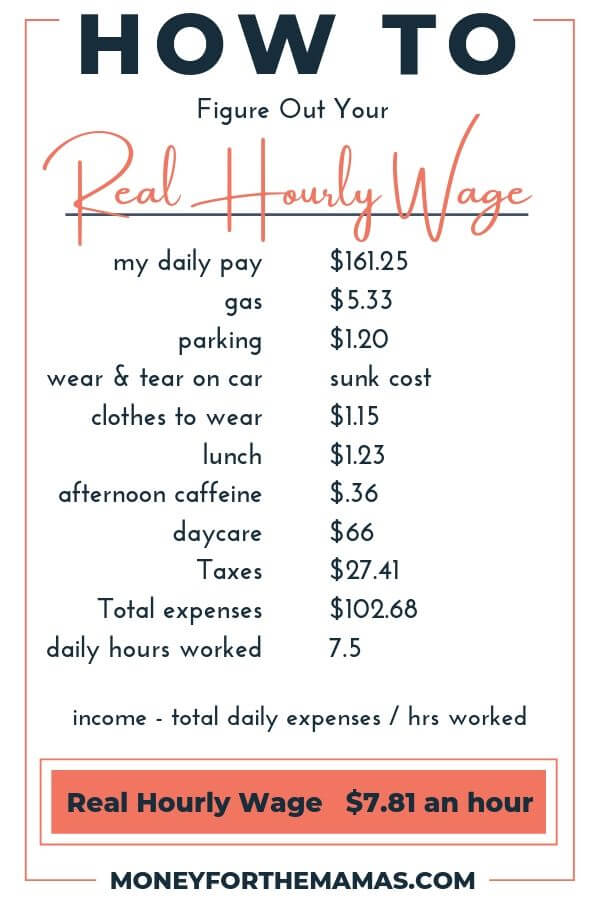

My Real Hourly Wage – Scenario 1

Income: I make $21.50 an hour, working 7.5 hours a day = $161.25 a day. Times that by three days a week = $2,094 a month. Not a lot. But I really do enjoy my job, and I find it meaningful work.

- gas for your car – $32 a week to fill the tank, about 1/2 is work-related. So $5.33 a day

- parking fee – $180 a year permit = $1.20 a day for 150 workdays a year ( I took out two weeks of the year for normal vacation time off work).

- wear & tear on your car – my car has 211,000 miles on it; it’s a sunk cost.

- clothes to wear – I am trying to shrink my closet, no add to it. But I do replace items that wear out. So let’s say guestimate that I spend $15 a month / 13 working days a month = $1.15

- lunch – I bring my own 90% of the time, so maybe 2 times a month, I spend $8 on lunch out. So $16 /13 days a month = $1.23

- afternoon coffee – I buy a Coke once a week on average $1.09 x 4.33 weeks / 13 days = $.36 a day.

- dry cleaning – nope

- daycare for little one – $66 a day – but we’d most likely spend that anyway (at least two days a week).

- professional fees – nope

So if you take my daily wage of $161.25 and take out 17% (my effective tax rate for 2018) = $133.84 a day

Adding up all the items above = $9.27 in expenses (I’m pretty frugal).

$133.84 – $9.27 = $124.57 a day / 7.5 hours = $16.60 an hour for my actual hourly wage

My Real Hourly Wage – Scenario 2

If you want to see shit get real, then let’s add in daycare at $66 a day.

($124.57 a day – $66) = $58.57 a day = / 7.5 hours = $7.81 an hour for my actual hourly wage

Ugh .

Let’s look on the bright side of things. With my job, I get adult social interaction, sometimes free food, and during my commute, I listen to podcasts. Oh, I forgot my commute, which can be 45-75 minutes each way, depending on traffic (20 miles each way). It’s lost time, but I fill it by listening to financial podcasts, so I am learning.

What to do now? How does this impact my spending?

In figuring out my real hourly wage, there are a few points that are rising to the top. Firstly, is my job worth it? Secondly, how does this affect my spending habits?

Let’s start with my job. I do very much enjoy my job. I work for a small Pacific NW company where I focus on community partnerships with non-profits and help employees experience the joy of volunteering with those who need a bit of extra love & support. It’s a great job, and I enjoy it. (It’s important to note that our family’s health insurance is through my Husband’s work.)

When I think about my spending, I think I will have a different lens when buying items. Really asking myself, “is this worth it?”. For example, I would like a new pair of jeans, as my favorite ones are worn out. I get jeans for about $80 at Nordstrom Rack. So $80 / $7.59 an hour for my real hourly wage = 10.54 hours worth of work. Ummm…. yeah, I’ll pass on jeans for a while.

Knowing your real hourly wage can make a big impact on your shopping patterns & spending triggers. When you know that you worked so hard for your days’ pay, is that worth one night of a bar tab? It’s all up to you!

You might say that the financial stress just isn’t worth it. And if that’s the case for you, then being able to stick to your guns, in the moment will be huge! (I’ll be rooting for ya!)

Save $900 a year with BillTrim

You don’t have to find a new (and cheaper) cable or phone company; that’s where BillTrim comes in.

You have the same providers; BillTrim just negotiates your monthly bills down. On average, they save their customers $900 a year (that’s $75 a month)!

Your Money or Your Life

This exercise is part of Vicki Robin’s critically acclaimed book Your Money or Your Life. Where she walks the reader through the process of really examining their behavior and their lifestyle, and how it is impacting their life. It’s genuinely a mindset-shifting how-to book that drives you to question the point of your life (that sounds extreme, I know).

One statement really struck me…

“And they call it making a living? Think about it. How many people have you seen who are more alive at the end of the workday than they were at the beginning? Do we come home from our “making a living” activity with more life? Do we bounce through the door, refreshed and energized, ready for a great evening with family & friends? Where’s all the life we supposedly made at work? For many of us, isn’t the truth of it closer to “making a dying?” Aren’t we killing ourselves – our health, our relationships, our sense of joy and wonder for our jobs? We are sacrificing our lives for money, but it’s happening so slowly that we barely notice.”

Vicki Robin

That’s real right there.

If you really want to dig deep into yourself and your spending habits and belief system about money (we’re talking big picture here) I encourage you to pick up Your Money or Your Life. It has a huge cult following and is a must-read for anyone trying to change their relationship with money!

Part of the teachings goes into figuring out what is really & truly important to you. Check out the post below to help get you started.

RELATED: How to Identify Your Personal Core Values & Using it to Succeed!

America’s take-home pay situation

Pew Research found that “on the face of it, these should be heady times for American workers. U.S. unemployment is as low as it’s been in nearly two decades (3.9% as of mid 2018) and the nation’s private-sector employers have been adding jobs for 101 straight months – 19.5 million since early 2010.”

“Despite some ups and downs over the past several decades, today’s real average wage rate (that is, the wage after accounting for inflation) has about the same purchasing power it did 40 years ago. And what wage gains there have been have mostly flowed to the highest-paid tier of workers.”

So the age-old conundrum comes up… How do I live in the manner I have been accustomed to if my dollar doesn’t buy that much? Good question and the answer is, your lifestyle will most likely need to adjust. Unless you’re okay taking on a good deal of debt (please say you’re not!).

If the figures are true about our dollar buying just as much as in the mid 80’s then consider this… “This was the decade during which “The American Dream” was born. People wanted the nice home with the picket white fence and landscaped yard.” The People’s History goes on to show house listings for that era.

- 1988 Syracuse New York, New Townhouses 3 bedrooms overlooking local forest from the $130,000’s. Not too bad as similar places are now running $280,000 on Redfin.

- 1989 Placerville California, Country Home 1 acre 4 bedrooms wrap around porch Bay Windows for $166,000. A similar home is now running $580,000 on Redfin. Yowwza, that’s quite a mortgage for our 1980’s paycheck to be handling.

At the end of the day

Figuring out my real hourly wage wasn’t the most uplifting of exercises, kind of a bummer actually. Yet, I know that it was necessary for me to figure out the cost & return of my job. What was more startling was getting my brain to process “this new Cuisinart would cost me 18 hours of work! Oh hell no!”

Going forward, I plan on keeping my eyes (more) open for opportunities to pivot, grow, and live a life that I feel has true value. Because I am more than just “working for a dying”, I am here to live!

Resources Mentioned:

Your Money or Your Life by Vicki Robin

Related Articles to Real Hourly Wage:

- How to Dump Your Financial Stress

- How to Conquer Your Spending Triggers

- Living Your Life by Your Personal Core Values

- How to Actually Stop Spending Money in the First Place!

thank you for giving such details. I need to review my hourly wage, never thought of computing and adding other things too.

There are so many small expenses that go into working a job, it’s crazy once you add it all up!

Great article!! But scared to do mine!! I commute for an hour everyday and tolls add up! Thanks!!

Ugh, I hear ya, commuting is a drain on so many levels!

Yes, very shocking how very little we bring home, for the time spent away from family, and the expenses it takes to get to and from a job! I agree, “life” is so important to live! I recently retired so I could be self-employed again, and love it! Great post!

Yes! Go live your life! ?

Interesting perspective, I tend to think this was as well. How would you calculate this when you run a business from home, your kids are homeschooled and your overhead is nothing? Would it be what you make afer holding out taxes, insurance, retirement contributions? I know my gross hourly rate but not my net.

Well, running a business from home has its own costs: office supplies, monthly/annual memberships, electricity, etc. Probably less expensive than traditional workplaces but still a consideration.

I have an approach the same way. Although I made it awkwardly simple.

Total pay after taxes divided by (24*14) hours. Was pay per hour with or without working.

The expenses are a bit more accurate of an approach. Love this!

Simpler is usually better I agree! Yet, for this formula my aim was to be very specific. Glad you liked it!

i love the detail of figuring out actual hourly wage. it’s actually pretty shocking when you really dive into the numbers. i’ve cut so many unnecessary costs over the years that have helped.

great article. very informative

So glad you liked it!

Wow, I never looked at my spending in this manner. It had made me more mindful of my expenses. Thank you for sharing! 🙂

Yes, it’s kind of a shock to think that you had to work 1.4 days to afford your jeans ?! So not worth it when you think of it like this!

Loved it! Even though I was aware of this, I had never thought it with so many exact details! It definitely needs more attention!

Yes, so many small pieces & details add up to a big chunk of change coming out, more than you realize!

I love the ‘how many hours of work will this cost me?!’ What a way to really SEE what you’re spending, especially when you’re buying … stuff. I can’t wait to figure out my actual wage, even though I’m a little afraid to.

Yeah, figuring out your real hourly wage can be a bit of a shock, but if it leads to positive change then it is totally worth it.