5 Simple Steps to Improving Your Money Mindset

What to do when your negative self-talk is taking control of your wallet!

Author: Kari Lorz – Certified Financial Education Instructor

You have a carefully cultivated money mindset, whether you know it or not. Is it helping you or sabotaging you at every turn?

Let’s break it down and show you how to kick that bad money attitude to the curb and finally start to win with your money. We’ll do this by identifying your money mindset and learning how to change it from a scarcity mindset to that of an abundance mindset!

Because let me tell you, your limiting beliefs are sabotaging your financial life, and it’s up to you to become your own hero!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

What is a Money Mindset?

A person’s money mindset is part of their overarching attitude and belief about money in their life. It influences almost every spending/saving decision that you make, and it does this automatically, just under the surface of your consciousness.

These underlying biases influence your attitude about money…

- Your money story (your past, your upbringing)

- Your money mindset (your current attitude & belief system)

Understanding why your money mindset is important

So you know what a money mindset is, and you have a vague idea of why it’s important, but let’s talk for a minute about how impactful it actually is.

Your thoughts are the basis for how you live your life; if you don’t believe me, then let’s look at someone who knows…

Your beliefs become your thoughts,

Mahatma Gandhi

Your thoughts become your words,

Your words become your actions,

Your actions become your habits,

Your habits become your values,

Your values become your destiny.

If you believe that you are doomed to struggle with money, then you will live that out through your actions. If you can change your money mindset, then you have conquered the biggest piece of the puzzle.

The Two Main Types of Money Mindsets

Your money beliefs are something that you learn (either consciously or subconsciously); no one is born with a set opinion about money. And this is good because if you’ve learned to believe one way about money, then you can learn a new and more positive financial mindset.

Let’s do a super quick overview of the money mindset spectrum. There are generalities, but you can click each of them to get more information and examples.

- Scarcity money mindset = negative feelings – anger, resentment, shame, frustration, etc. There is never enough money.

- Abundance money mindset = positive feelings – relaxed, worry-free, confident, etc. There is always enough money.

How to change your money mindset.

1. Recognize the need and your ability to change

Now you don’t need to change your money beliefs all in one day, but you need to make the first step today. Tomorrow you take one more, and then so on and on. Just keep going! When you take control and say enough is enough, you are fired up and ready to change. You can’t be medium-fired up. You need to have your game face on and have the snacks packed and ready to go!

To figure out HOW you can get yourself fired up about your personal finance journey, check out how I found and keep the drive going strong each and every day by identifying my financial why.

Where consciousness is, action follows.

unknown

2. Understand where your money mindset comes from

You need to know where your money beliefs came from so you can debunk them. You hold the power to take your long-held belief and ask yourself “Is this belief always true?” 99% of the time the answer will be no. Expand on that answer, list reasons as to why it’s not true.

Sure there might be a few specs that are usually true. But the main thing is to tear down the certainty of this negative belief that you hold. These are called limiting beliefs because they limit you from reaching your potential.

Once you figure out that the thing that has been holding you back is a lie, it doesn’t have power over you anymore. You can emotionally let go of it and work to rebuild what you know to be true.

3. Make a plan and write it down

If you want to achieve a financial goal, then you need to plan it out! You can’t just vaguely go about things and sometimes take action. You need to spell it out for yourself, so you don’t need to second guess or rethink things. You just need to be able to execute the plan!

An article in the Huffington Post cites research from Dr. Gail Matthews, a psychology professor who was working on the science of goal setting. She had a test group of over 250 people and broke them into two groups: those that wrote their goals down and those that didn’t. In the end, she found that you become 42% more likely to achieve your goals by just writing them down regularly. (source)

Writing your financial goal down is key to staying motivated during your journey. Or pick some meaningful positive money affirmations or a money vision board. Something that will inspire you on your path to financial freedom (no matter what that looks like to you).

Decide what you need to do, be very specific on things (in fact, using the SMART method for financial goal setting is a great idea to be sure that you are detailed enough), and then get to work!

4. Interrupt harmful thought patterns & replace them

I will freely admit that one of the hardest things to do is to stop yourself mid downward spiral. This negative pattern is engrained as your habit, but we need to change that habit! The first thing to do is to interrupt the pattern.

Once you realize that you are going in a bad place, you need to STOP. Tell yourself to hold up, do something that gets your attention. Now, these next two tidbits will sound silly, but that’s okay; we just want to shake you up enough to let logic peak through in that moment.

Silly Interrupter #1:

“You better check yo self before you wreck yo self

Cos I’m bad for your health, I come real stealth.”

DANG! Did I just drop some Ice Cube on YOU? Funny that the two lines of lyrics above are so apt to what we are talking about!

Your silly saying or anthem doesn’t need to be Ice Cube; it can be anything catchy. It just needs to give you a pause and pull you out of that spiral.

Silly Interrupter #2:

Give her a name! We all have that devil inside of us, that side of you that’s snarky, mean, judgy, whatever. So that’s “her”. Let’s call her Gina (I sincerely apologize to all the Gina’s that may be reading this).

So you start talking trash to yourself because you forgot to budget in the increase to your internet bill into your monthly budget, and now you’re overspent!

“How could I forget that? I’m so stupid!”

Wait! HOLD UP, Gina! Call her out, make her “not you”. It’s like the saying goes, would you talk to your best friend the way that you are talking to yourself? NO! You would never be that harsh to your friend. So tell Gina to take a hike!

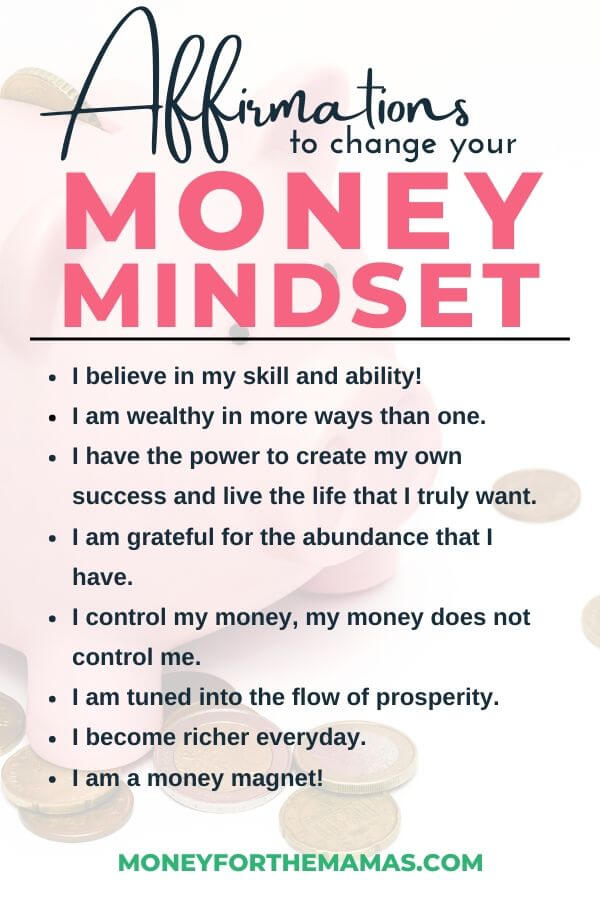

Once you have gotten good at interrupting the negative thought patterns, you can work on replacing them. People often call these positive affirmations. At first glance, they feel odd coming out of your brain, but once you get the feel of them, they flow easier. Here are some positive money affirmations that you can use…

- I will happily spend money on planned purchases (vs. I will not splurge).

- Success, money, and happiness come easily to me (vs. I will not think about how we are always doomed to be living on the edge).

- I may stumble, but I will always get back up.

- I will pay off my debt, one day at a time; it will happen.

- Say to yourself, I believe in my ability to succeed. (this is one that I personally use.)

- I am creating financial security and building wealth for my family every day.

- With hard work, I will reach my goals.

Or create your own affirmations with the workbook…

If none of these feel quite right to your problem, you should check out the master list of 250+ money affirmations! If you’re looking for help then grab the Money Affirmations Workbook, where you have all the affirmations here listed out (it makes for easy highlighting)! And it walks you through creating your own personal affirmations.

5. Focus in on what you already have that makes you feel abundant

Do you have something that you are proud of? Something that you worked hard for? Or something that makes you feel wealthy/abundant?

Maybe you’re super proud of your veggie garden in the backyard. You worked so hard on it all spring & summer! And now, you’re reaping the rewards of huge juicy tomatoes and sweet corn on the cob! Your hard work paid off!

Or maybe you have this fantastic hand lotion; it’s super silky, smells amazing, and you love it. You splurged about bought it for yourself on your last birthday. This makes you feel rich, abundant, and happy!

Or, when you have all your family around you, maybe at the dinner table, you feel the abundant love in the room. You hear the laughs, see the smiles, and know that you are a part of this warmth, and you feel the strength and comfort that comes with it.

These examples showcase your happiness in abundance but in different ways. Focus on these feelings of luxury, and you should bask in it, wallow in the richness of it, and be grateful for it.

Part of having a healthy money mindset is practicing gratitude, which can be difficult. It’s “hard” to be grateful for all the challenges you face. Yet, if you shift your thought process to be thankful for how far you have come and all you have overcome, you will see that you are more resilient than you thought. This in itself will reinforce that you have what it takes to change your financial life for the better!

Plus, putting this good energy out will raise your vibration. It will help you focus on the positive, and remember from above; positive people are healthier & happier!

Scarcity money mindset

“Dang, $140 for new glasses for my kiddo, there goes my budget! It doesn’t really matter if I spend another $32 on a new shirt I want.”

So you spend the extra $32, not realizing that you were already doomed from the beginning. Because no matter what happened that day, you were going to think and feel negatively about your purchases and push yourself deeper into a hole. This is what you have always done to yourself, so this is what you will continue to do. Until now!

In the above example, where they were angry and fearful, that is what the pros call a scarcity money mindset. You never have enough money, and you will NEVER have enough money!

Maybe you think you don’t deserve good luck with money, and perhaps you believe you are trapped in a situation or that you’re doomed never to get ahead. You are constantly being held back or dealt the poo-poo end of the stick. (Yes, poo-poo is a legit term in my household right now.) You may have some significant money blocks – those are limiting beliefs that hold you back from having the financial life you want.

Thoughts of lack manifest as limitation. Thoughts of abundance manifest as success and happiness. Failure and success are but two ends of the stick.

Ernest Holmes

Forbes says that limiting beliefs are “commonly referred to as money blocks. Negative money scripts can have disastrous effects on your financial situation because what you think affects how you feel, which then shapes the actions you take and eventually, the results you get.”

These money blocks are so easy to get caught up in, so you need to actively tell yourself that it’s not true! You need to say to yourself that you have a choice about how you feel (because you 100% do).

The choices you make on a daily basis build habits, and those create your core beliefs, and those influence your actions, and those impact your feelings, and the circle continues. Don’t let the vicious cycle of a negative money mindset trap you!

You may need to reach out and talk to a professional about these negative thoughts, as one area in your life can spill over into others. Especially if these are long-held core beliefs from our childhood.

For example, a child that’s been told they’ll never amount to anything time and again will have a hard time reaching for a promotion at work. They’ll think, “Why even try, I’m not qualified for it anyways. No new job equals no raise; I’m doomed.” This type of negative mindset is also called a fixed mindset.

A fixed mindset is a person’s belief that we are what we are; we cannot change. It’s a belief that we are born with certain abilities, and we cannot learn or cultivate and develop a skill, which is just silly because obviously, you have earned to do a lot, like walk, talk, drive, etc. Our future self is counting on us to change and grow!

Having a scarcity mindset can also manifest in your attitude about others’ success. You may focus on what they “got,” and if they got something, then that means that you didn’t get “it.” Because there is only so much of something to be had.

A good example of this is a cake. If your brother got a slice, then that means one less slice for you. That’s a scarcity belief. You may feel jealous or resentful of that person, and that’s a hard place to be in.

These mistaken core beliefs run deep in our subconscious, don’t dismiss them, and don’t let them breed anger and resentment. Work to recognize that these negative thoughts are wrong, and open your mind to the possibility that there is another option, a brighter option. (aka you can always go and buy or make more cake).

That’s all you need in the beginning, a tiny opening to do some money mindset work. Now, let’s look at where you (and I) and everyone else want to be, the land of an abundant mindset!

Abundance money mindset

On the opposite end of the spectrum is the abundance money mindset. Where you feel that you will always have “enough.”

Yes, you know that there may be small setbacks or unexpected blips, but in the end, you know deep down that it will all work out okay. Not because of divine intervention but because you can always change things, do things differently, learn more, and make financial decisions that will lead to wealth.

Another way this manifests is when it’s called a growth mindset. “A growth mindset, proposed by Stanford professor Carol Dweck in her book Mindset, describes people who believe that their success depends on time and effort.

People with a growth mindset feel their skills and intelligence can be improved with effort and persistence. They embrace challenges, persist through obstacles, learn from criticism, and seek out inspiration in others’ success.” (source)

They know they can do it! They believe in their ability to grow.

Abundance is about being rich, with or without money.

Suze Orman

Back to the above example of your child needing new glasses. So you spend the $140 for new glasses, and you think, “okay, that wasn’t planned, but I’ve been able to put extra aside these past few months because it’s spring, and we haven’t needed to turn the heat or a/c on. So it’s okay.” This is an example of a positive money mindset, that of an abundant money mindset.

Same person, same expense, but a different money mindset = a new outcome, with less stress, depression, less self-defeating attitude. Oh, and you saved that $32 because you didn’t buy that shirt. Since you didn’t buy it, you also kept yourself from feeling bad about that money mistake too!

It comes as no surprise that those with an outlook of abundance don’t stress out over money problems as those with a scarcity mindset. They don’t lose sleep, they don’t hold money grudges, and they give more freely with their possessions and their money. They can afford to donate to a nonprofit because they know there will always be more money for them later on.

When you have established where you are in the scarcity & abundance sliding scale, you can dig deeper into your specific money personality traits. This will help you identify “what” is tripping you up and where you should focus on to help transition to a more abundant mindset.

How your money mindset develops – your money story

Before you dig into your current money mindset, you need to know how your money story was developed.

Your money story is how you were raised with money; it’s your narrative. You learned about it from your parents, your society & culture, and it’s usually generationally based (aka being older typically means having more traditional viewpoints).

You learned about money not only from what your parents taught you, but you mostly learned about it by observing their behavior, their interactions, and their emotions when anything financial-related was in the air.

Your money story helps to shape your current money mindset.

More resources to help you explore your money mindset

- Zenkina, Kathrin (Author)

At the end of the day

Changing your mindset about how you feel about money isn’t an overnight process. But I genuinely believe that it is the starting point part to improving your financial situation.

Because when you fear something, it has power over you. When you have a plan, you have control over it.

Changing your money mindset is an essential step in changing your financial future. It can also be the hardest, as you may really not believe that change is possible or that it’s too late.

It’s okay. Take a deep breath, have faith in the process. Make your plan, say your affirmations, and soon you will feel a shift. I believe it, and soon you will too!

Articles related to money mindset:

- You Need “THIS” if You Want to Hold Onto Your Your Money; finding your financial why!

- 4 Actionable Steps to Keep Your Money Motivation Strong & Solid

- 250+ Money Affirmations to Catapult Your Wealth!

- How to Change Your Tragic Money Story to One of Triumph

- Conquer Your Money Demons by Dumping Your Limiting Beliefs About Money

- Wishing for Wealth? Here’s How to Manifest Money

Money mindset is really great and helpful. Because this asset will help you in your bad days. Thanks for sharing the article.

So glad you liked it Reese!

Thank you for sharing this article to us. It’s true that Changing your mindset about how you feel about money isn’t an overnight process but it’s not late to start now.

It’s never too late to start! Start now! 🙂

I love this concept–so spot on, as with most things perspective is everything!

Yes, a healthy dose of perspective is key!

Wow. This is such an informative and inspiring article. Love it! Thanks for sharing!

So glad you liked it Faith! Thanks for stopping by!

This is incredible information. I’ve definitely been on both ends of the money mindset!! I’m a recovering shopper haha!

Ya Yvonne! Being a recovering shopper is a noble badge to wear! I was a Nordstrom groupie basically in my 20’s so I totally get it!

This was perfect currently trying to pay down debt and save for a house. So figuring out what my money mindset it will help tremendously.

Best of luck on your debt-free journey, so glad you think a mindset shift content will be helpful!

Thanks for this post! I am guilty of having the scarcity mindset sometimes and definitely have to change that! I love the affirmations you shared and will think of them regularly now! 🙂

When I started out, I absolutely had a scarcity mindset (with so many things) but a gradual shift happened when I focused on it, and I feel (literally can feel) the shift in my outlook and potential!

Great article! Mindset is everything. I LOVE the “You Are a Badass” books!! I plan to read “Miracle Morning” soon and recently started reciting affirmations for money!

So glad the books helped you! You’ll love Miracle Morning!

Mindset is so crucial! I believe in it for sure. It’s what made all the difference for me and led me to become debt-free!

Yaaaaa! Mindset absolutely makes a difference!

thanks for all the great tips. writing a plan down and working towards it definitely helps. One goal for my husband and I was to be able to be able to have one income and for me to be a SAHM. And here we are! Its all about mind set(:

So glad you reached your goal! Doing that is so empowering, and now that you know you can do it, you can repeat it, time and time again!

I’m still uncovering more things about how my childhood has shaped my money mindset and I’m changing it to match my future!

I totally get it, our childhood has so much influence over how we feel today, even decades and decades later. Conscious action is needed to break those old ties and build a base that supports you!

When my husband and I first got married we decided that we would learn how to live on his income and use mine to pay off debts. That way when we decided to have kids I could stay home if I wanted to and we wouldn’t miss the income because we were already used to living off of his. By the time we had our first child 5 years later we had paid off all of my student loans and had paid off the majority of our mortgage. During those 5 years of trying to pay off debt several unexpected expenses would come up and I would cringe every time we had to pay them because I knew it was getting in the way of paying off our debts as quickly as possible. I definitely lean toward the abundance of money mindset, but it still bothers me when unexpected expenses come up. I just try to roll with them as best I can.

I too cringe with unexpected expenses, but honestly, I just remember that’s why we have the funds set aside, for this exact reason. Congrats on your debt payoff story, so inspirational to see moms (just like us) killing it!!!

I like the idea of money affirmations! I’m going to try that tip starting tomorrow. Thanks for sharing!

Yaaaa, you are a money magnet!

make a plan! Yes! I’m terrible when it comes to money. My husband and I have goals and we’ve started writing them down to help put them in perspective for us and it’s working! This is a great read!

So glad you’ve started to take action! PS – You’re not terrible with money, you just haven’t put your full focus on it yet, you will do great! 🙂

Great advice! I’m currently trying to pay off a credit card, pay for an open university degree, pay for life in general, and save for a mortgage, so every little piece of advice I can get helps! Going to have a good read through and make some notes, so thank you!

So glad you liked the piece, I hope you found something in it that resonated with you! Good luck with your journey!

These are some really great tips! Thank you for sharing

So glad you liked it, thanks for stopping by!