Financial Literacy – How I Learned the Most Important Life Skill

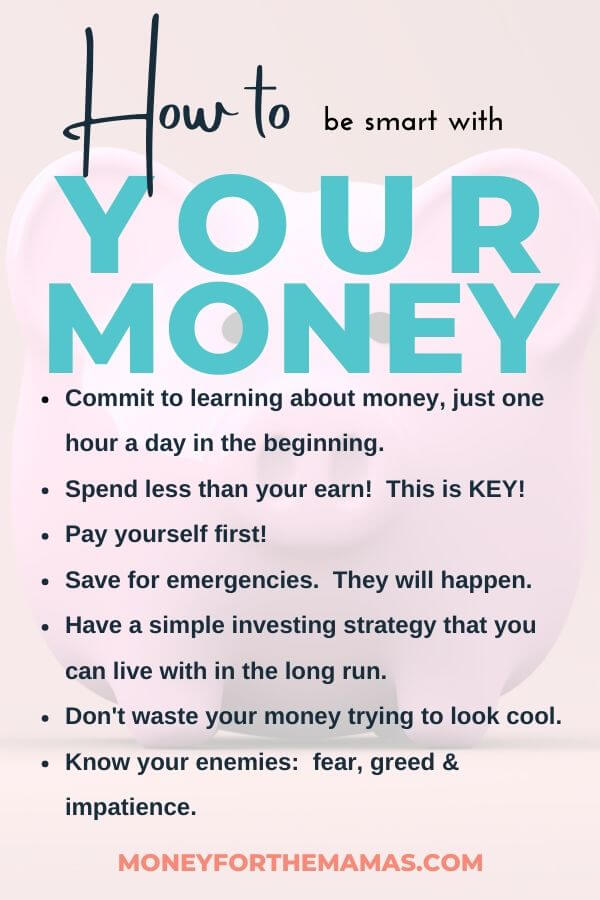

In just one hour a day, you can completely change your life by focusing on financial literacy!

Author: Kari Lorz – Certified Financial Education Instructor

Our relationship with money is one of the most important relationships we will ever have.

You need to have a healthy relationship with money because if you abuse this relationship, it will drag you down under. It will consume you (aka bankruptcy, or greed, etc.)

Yet, you may not even realize this until years later, just like me. I now know that the key to this relationship is knowledge, specifically financial literacy.

So are you like I was? Are you sabotaging yourself? Oblivious to the damage?

Read on and learn how my ignorance kicked into a drive to learn about all things money, why I share this info with you, and how you too, can change your family’s future to reach your dreams!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

Oblivious to why financial literacy is important

I was part of the problem, not even knowing I was in trouble. Oblivious to missed opportunities to set myself up for success by saving more. I don’t want that for you!

If you’re reading this now, you haven’t given up hope of changing your life for the better! You are here to learn, map out your goals, and get going on achieving your family’s dreams!

I wish I had reached out to people who knew about money, but I didn’t know anyone anyway. Yet, the internet has changed all this, and there are so many places to find people who are interested in money.

Facebook groups are a great place! I recently asked one group what their favorite piece of financial advice was, and the response was amazing, be sure to check it out!

At the highest, my husband and I were $17K in debt, living in my mother-in-law’s basement, trying to save money to buy a house so we could finally start a family.

I wasn’t working as I was trying to completely switch career paths, which made it even harder for us to stop the bleeding and save for a home.

I started as a “beginning budgeted,” a total newbie, I spent only $60 a week for groceries for 2.5 people (my mother-in-law would sometimes eat dinners with us), but I wanted more from life.

I did get a job, not in the field that I wanted, but close enough to fulfill what I needed from a job. We did get a house, and we did have a baby.

Now, years later, we have a six-figure net worth. Not too shabby. I’m not saying this brag or to say, “wow, I’m amazing!” I’m saying this so that you know that a regular, everyday person with a starting financial literacy score of 12 out of 1000 (I made that score up, but you get the picture) can change their life, then so can you!

Benefits of financial literacy

There are some basic and obvious benefits to expanding your financial knowledge, but let’s take a moment to go over them, so we’re all on the same page.

When you learn about money, you begin to be a better manager of it. You spend less, save more, and overall have more stability and less financial stress. The stress usually comes from carrying consumer debt, and the uncertainty of the future (i.e., your living situation, ability to care for your family, etc.).

These are significant things, and our “money problems” begin to consume us.

So the main benefit to better managing your money is less stress, which can wreak havoc on our mental and physical wellness. What this looks like is that we have a more stable home – not moving too often, happier family dynamic, we can afford higher education, enjoy more hobby activities, etc.

Why financial literacy is important for me – the beginning

When I became a new mom, my focus forever changed. It was probably the same for you too. I thought about things differently; I even thought about things that I never even considered before.

I envisioned how I wanted to raise her with kindness, compassion, strength, and resiliency. I wanted her to have every single opportunity to succeed and to be honest, that’s why my husband and I waited to have kids.

Even though I wanted all of these great things, I was oblivious to what that actually meant from a financial health standpoint. I had always been a decent saver, but of course, in my younger years, I bought things I shouldn’t have (without even knowing it).

I bought a brand-new car, clothes I wouldn’t really wear, a gym membership I hardly used, and a condo. My savings were measly, but I didn’t know any better. I thought I was doing a good job putting $50 a month into my retirement account.

But, obviously, that amount isn’t enough. When I learned that, I knew things needed to change, and to do that, I needed to build knowledge and develop financial literacy skills to improve our financial health.

The basics of financial literacy in America

People often joke about couponing, but it started me on the path of learning about value. What is something “worth?” Do I have to pay that amount, or can I get it for less if I plan it out a little bit?

In 2013, our financial situation was that we were $17,000 in debt, had no house, and didn’t have a job. YIKES!

So I couponed and became a detailed and strict budgeter. Finally, a year later, with a little bit of help from our family, a job, and selling my condo (I hardly broke even on it), we were about to buy a house!

We had climbed out of the hole. By this time, I had read a few of the Dave Ramsey books and had even started listening to his podcasts. They are very informative and decently entertaining.

While listening to a podcast, they talked about a recent, fairly large survey that they had done, “Today’s Retirement Crisis.”

Some startling facts were…

- 42% of Americans are not saving for their future

- Of the 58% that are saving, only one in ten are saving the suggested 15%

- Only 31% of millennials, 51% of GenXers, and 46% of working baby boomers have at least $25,000 saved.

- They broke it down by income levels and found that only 9% of upper-income earners are not currently saving, while 35% of middle-income earners are not saving, and 68% of lower-income earners are not saving.

- Women are twice as likely to have nothing saved than men (ouch!)

After hearing these things, I (sad to say) instantly felt better about what our situation had been. Whew, we weren’t the only ones! Others were just as confused as us! Then after a few minutes of feeling all good about belonging (and not the only one sucking it up with money), I felt confused. Why were so many of us having such a hard time with this?

Formal financial literacy education

Another Ramsey study really pushed me over the edge, and it said that “More than 60% of American workers currently contribute to a 401(k), and they expect their 401(k)s to be a top source of income when they retire. BUT that 40% of workers say that their workplace does not provide any type of retirement or financial education” (source)

So we are just expecting people to know already how to do these things. Well, let’s see how “we” all learned about money. The study finds that the most common ways people learn about retirement are

- 35% learn about it from their work

- 35% learn about it from their parents

- 32% are learning it from family & friends

No wonder no one knows how to manage their money! We were never officially taught how to handle our money from an educated/official source! Who cares about the sides of an isosceles triangle when they have bill collectors calling! Why did school not teach us these things? Why are we dooming ourselves to failure from the get-go?

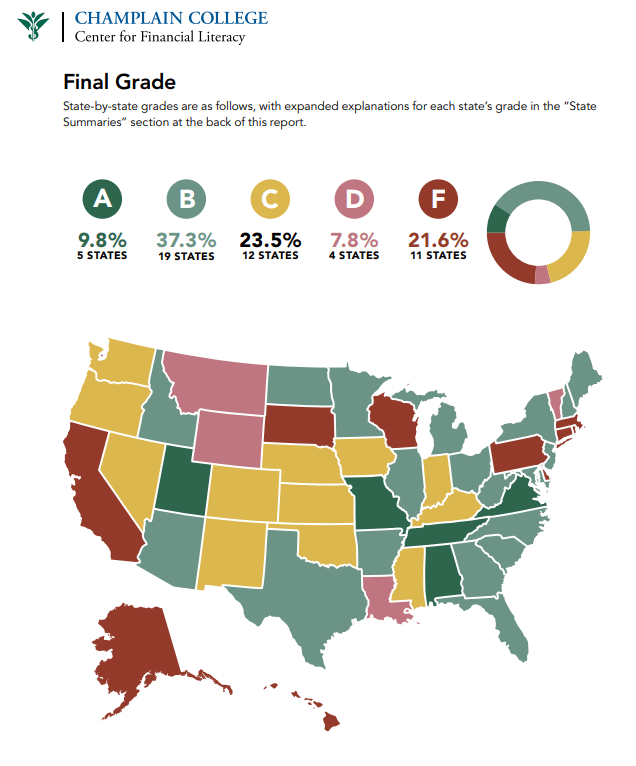

Champlain College did a huge study a few years ago where they rated each state on their HS financial teachings, and it was sad. The graph below is showing the results of each State’s overall financial education curriculum.

We, as a nation, are creating generations of idiots (when it comes to financial literacy). Because we don’t have a financial literacy program built into our school teachings (as a collective nation).

We were happily bleeding to death, setting ourselves and our children up for failure! More so, we were miserable. I mean, we are happy because we buy everything we want, but at the end of the day, the bills keep coming, each one higher than the last. We’re not slowing down; we are speeding up.

Large corporations take advantage of our ignorance and sell us huge mortgages, leased cars, and boats. (unless you are Popeye, you don’t need to own a boat). I was pissed; I still am a little, to be honest.

So for six months or so, I sat on this anger, yet still voraciously learning about money matters any way I could! Lots of books, lots of podcasts, lots of magazines, and lots of googling! I was slightly obsessed. I gleefully sat at home on Saturday night in my pajamas playing around with mortgage payoff calculators.

Sharing basic financial literacy – my start

With my newfound personal finance obsession came an urge to share this info with my fellow workers because I knew that, as a company, they didn’t “teach” us anything. In fact, the only opportunities to learn came once a quarter, where you could sign up for 15 minutes with a rep from our retirement plan company.

Boo! With the time slots allotted, only 7% of our store staff had the opportunity to sit down with this person.

So I asked my boss to let me teach DR’s Baby Steps through a book study program. I had seven people go through it the first time and another seven people the next round.

It felt amazing teaching people how to build an emergency fund, what compound interest was and why it was so important, how to pay off their credit card debt and how that impacts their credit score, what an interest rate was, and why we should even care about it!

If you want a quick guide to improving your finances, check out my 31-day financial goals post. It’s a short one or two paragraphs for each day of a month on what you can do to learn more about handling your money!

Or, if you know that you need to start budgeting (the most common goal), then don’t waste any time; get started today! I have an Ultimate Guide on How to Budget all ready for you to dig into!

When Moms think about money, it’s usually regarding their household budget, and how to buy everything their family needs while not going crazy spending money! Yet, as Moms, we also have the instinct to protect our family.

There’s a lot that we can do behind the scenes to set our kiddos up for success. Check out this post on making a DIY Financial Plan to build a secure financial future.

Financial literacy for women – my goal

I loved learning about money, and what’s more, I took notice of who was talking about financial concepts and strategies. I was listening to their language, their familiarity. For the most part, they weren’t talking money for me. They were talking about money for people like my husband. Men.

Making sports references, bro talk, beer ads, stuff I didn’t really relate to or connect with. For an instant, I thought, “maybe this isn’t for me” I thought that maybe I was in over my head.

Fuck that!

I was smart, damn smart. As an adult, I deserved to be a part of this conversation! Because if I had felt that way (even for an instant), then I know others did too. There were women just like me trying to learn, trying to achieve great things for their families. What if they got overwhelmed and gave up? I prayed that they didn’t. I pray that you won’t give up.

I realized that if women all around weren’t feeling a part of the conversation, then we needed to start our own conversation!

This is why I’m here. I’m here to have a discussion with you about money! About what you want your money to do for you, what are your financial goals, and do you have a financial plan?

I want you to have your money plan so well laid out and executed that you have the luxury of forgetting when payday is. I want you to feel secure that you’ve covered all your bases if the worst should happen. I want you to know and be confident that you have set your financial life up in a way that will build you and your family the future of your dreams.

I know things can get rough when first starting, especially when learning about something as intimidating as money. That’s why you need to have a very strong “why” behind you. What I mean by that is, “why are you even doing this?”

I shared my story and how you can find your “financial why.” Having your “why” will help keep you going when the going gets rough! So figuring this out is Step #1!

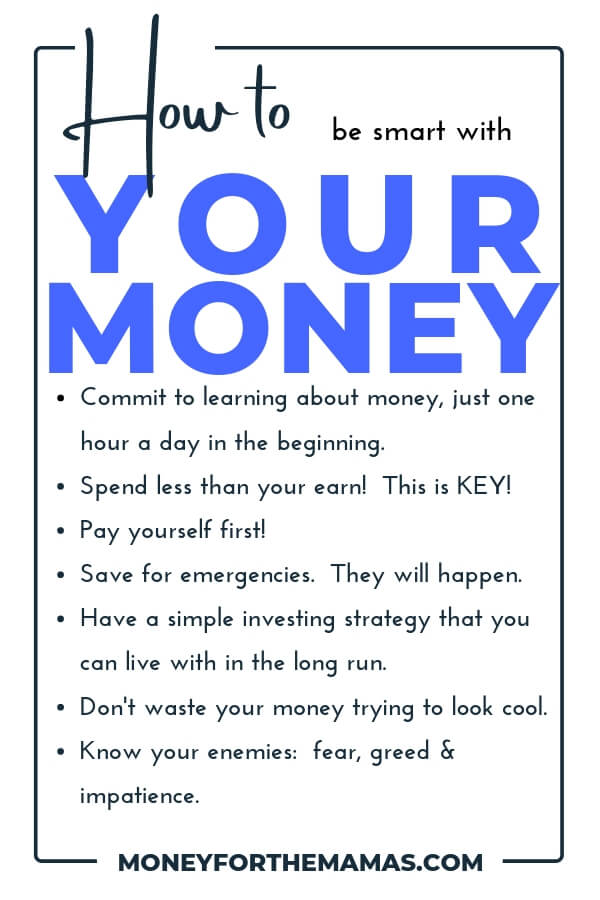

I challenge you! I challenge you to take just one hour of your day and use it to build a better future, one hour a day learning about basic financial concepts like retirement planning, debt payoff like a student loan, savings accounts, and more!

I want you to go to bed each night knowing that your children will have full bellies, happy hearts, and bright futures. I want that peace for you. So let’s start learning, thinking, planning, and implementing money management strategies and plans to get you there! Because YOU are a part of this conversation, make no mistake, you belong here!

One of the best ways to learn about personal finance is by learning straight from an expert! There are some fabulous money teachers out there who have written life-changing personal finance books!

Be sure to check out my top 10 recommended financial literacy books; you’re bound to find the perfect one for you!

At the end of the day

I started learning about money on my daily commute, approximately one hour a day. The more I learned, the more curious I became, so I started to devote more time to learning.

The more I learned, the more I was determined to act – build a better budget, spend less and save more, make smarter purchasing decisions, looked at long-term goals vs. short-term benefits.

Over time I made better and better financial decisions, and we dug ourselves out of debt and built a healthy net worth, and we have a financial plan set up so that trend continues.

Yes, at first, personal finance is rather intimidating, but it gets easier the more you familiarize yourself with it. Don’t focus on your limitations; focus on your growth potential, and you will set yourself and your family up for a brighter future. And yes, it all starts today!

Related Articles to financial literacy:

- You Need Your “Financial Why” if You Want to Hold Onto Your Money

- Ultimate Guide on How to Budget

- 31 days of Financial Goals

- Mastering Your Money Mindset

- How to Make a DIY Financial Plan

- Budgeting 101

Financial literacy is very important for one as it allows you to express your expectations in a clear and concise manner and assist you in accumulating wealth, protecting the future of your family, and establishing retirement plans, allowing you to live a life free of stress and worry.

Absolutely yes to all of these things! Improving your financial literacy can get you there!

Managing personal finances today is more complicated only because people are unaware of the things that help them in managing their finances. Knowledge of financial literacy is very important for one to become financially strong. One should join financial literacy programs to gain financial knowledge.

Yes, people aren’t even aware of all that they don’t know about managing money. And if they don’t know about it, they won’t know to study it, a horrible cycle.

Thank you for sharingg.

Financial leteracy is a real need in today’s world.

You’re so welcome! Thanks for stopping by!

Thanks for the sound and thoughtful advice!

You’re so welcome!

Money is a pretty taboo topic for most Americans! Great info.

You’re totally right, the easiest way to break the stigma is to educate!

Money is HARD. I’m definitely working on it, and our finances are in a mess right now because our house was broken into, we’re working on replacing everything, and we’re going to sell our house and working on updates/staging…. phew! Small steps.

I’m so sorry you’re going through this! Such an awful experience, which impacts everything. I’m keeping my fingers crossed that it all comes out okay!

Great thoughts on financial literacy. For sure something to think about. Definitely worth an hour a day!

So glad you liked it!

Kari, you are so right that we can be financially illiterate not even realize it. But if you’re never really taught about money and then you get sprung into adulthood then it’s like…okay, go figure it out! No wonder we all end up in debt and struggle for years before some of us finally do figure it out. Good message!

I think we as a community haven’t pushed enough for this to be a part of high school education more. We’re “taught” that talking about money is impolite or crude, and this attitude has to change!

I love this! I completely resonate with this! That’s why I also started my blog 3 months ago with the goal of transferring my knowledge online and someday to my daughter! 🙂

And it’s true! There’s not enough finance blogs out there for women yet more and more we are the money managers for all things family related. So glad to have found a voice that I can relate to 🙂

Yaaa!!! We absolutely need more female voices in the money management sphere! So glad to have you join us!

What an inspiring post! Thank you!!

So glad you liked it! Bringing awareness to how money issues effect kids (not just with having or not having possessions) is important.